We Answer the WSJ’s “19 Questions to Ask Your Financial Adviser”

As we have previously written, it is difficult for investors to know what to look for in their search for a financial adviser (or advisor). In his most recent Intelligent Investor column for the Wall Street Journal, Jason Zweig updates the timeline of the fiduciary rule and points out that since its delay, “the burden of finding someone who will act in your best interest is on you.”

We would argue that even the best rule wouldn’t eliminate this burden. To that end, Zweig arms his readers with a list of questions to ask their financial advisor (in bold) along with his desired response in the parenthesis.

Below each question, we weigh in with our own responses that, in our view, align with what Zweig would hope to hear.

- Are you always a fiduciary, and will you state that in writing? (Yes.)

Yes and yes…and we have been since 1988. Question #1 is in response to the Department of Labor Fiduciary Rule which requires advisors to only act as fiduciaries with regard to retirement accounts. The two main problems we see are that the advisor doesn’t have to be a fiduciary on non-retirement accounts (which are estimated to be one-third of all managed assets) and the minimum standards for “fiduciary” in this context are watered down so that it isn’t a meaningful improvement for many investors.

Said another way, if a new Fiduciary Parenting Rule required me to act in the best interest of two out of my three kids and so I revised my parenting practices to now comply with the minimum standards, could you say I was really acting in the best interest of my kids? We think being a real fiduciary means wanting to be a fiduciary for all clients, all accounts, all the time.

- Does anybody else ever pay you to advise me and, if so, do you earn more to recommend certain products or services? (No.)

No. We are only paid directly by our clients, regardless of how we invest for them.

- Do you participate in any sales contests or award programs creating incentives to favor particular vendors? (No.)

No. Upholding a fiduciary standard means shunning any and every incentive to invest any client funds into an investment for personal gain. Even our outgoing phone message is worded to weed out mutual fund wholesalers who try to offer us a “free lunch” to hear about their funds.

- Will you itemize all your fees and expenses in writing? (Yes.)

Yes. We do this at the outset of our relationship and fees are clearly detailed on the first page of every statement we send clients. You would be surprised at how often we have a prospective client come to us with their current advisor’s statements and, even after decades of experience, it is difficult to determine exactly how much they are paying.

- Are your fees negotiable? (Yes.)

Here is one answer where we disagree with Jason. He would prefer fees to be negotiable, we would prefer them to be reasonable, fair, and without preferential treatment.

For example, currently, 2 out of our 3 kids are in braces. Let’s say my orthodontist quoted me $4,000, but then I ask if that is negotiable. Would I rather my orthodontist say “Yes, now that you’ve asked, I’ll take off $500?” or would I rather she say “No, that’s the best price I can give you and that’s the price I charge all other cases like yours.”

The discount, while nice for me, would have left me wondering why I wasn’t charged a fair price to begin with. It also leaves me wondering about the other patients that day who didn’t ask for a discount? Are they now overpaying?

Of course, that doesn’t mean all of my kids’ braces will cost the same. Kid 1 started her braces as a result of breaking her jaw and she’s been in them for three years. Kid 2’s overbite is going to require two phases or braces. Similarly, our fee can vary due to the complexity of the client. I would suggest a different question: “Is this the best price you can give me?” and our preferred answer would always be “Yes.”

- Will you consider charging by the hour or retainer instead of an annual fee based on my assets? (Yes.)

Yes but only for special circumstances. The majority of our clients pay us based on their assets that we manage for them, although we have performed some hourly work for one-time special situations such as a divorce or an in-depth second opinion. While some planners do a great job offering hourly planning (usually without investment management), we’ve discovered it’s not a great fit with how we view financial planning and investing.

- Can you tell me about your conflicts of interest, orally and in writing? (Yes, and no adviser should deny having any conflicts.)

Yes. We have no conflicts of interest as far as government securities regulators would be concerned. However, as Jason’s linked article above points out, we always have honest and transparent conversations about potential conflicts of interest. We recognize that we have the potential to 1) want to invest more of our client’s dollars and 2) grow those dollars. We manage these potential conflicts by adhering to a fiduciary standard both as a Registered Investment Advisor and members of fiduciary focused professional organizations. More importantly we’re wired as fiduciaries in our firm’s culture and our personal beliefs. So while that potential is there, we’ve told millions of dollars under our care to leave our management in order to go pay off debt, start a business, or give to charity. A fiduciary standard of care encompasses knowing what is important to each and every client. This doesn’t eliminate the potential for conflicts to arise, but it certainly addresses how we avoid those conflicts.

- Do you earn fees as adviser to a private fund or other investments that you may recommend to clients? (No.)

No. See #2 above.

- Do you pay referral fees to generate new clients? (No.)

No. And I would also suggest an additional question, “In the average week, how many hours do you spend on client matters (meetings, planning, investing) versus prospective client matters (sales, marketing, prospecting)?” Even if an advisor isn’t paying someone else to generate new clients, that advisor could, in practice, be a salesperson. I spoke with an advisor friend who has 25+ meetings per week, the overwhelming portion of those with prospective clients. It made me wonder who is doing the work of actually being the advisor. Alternatively, we have set up our business to provide financial planning and investment management for our clients, not to hit a “sales” target.

- Do you focus solely on investment management, or do you also advise on taxes, estates and retirement, budgeting and debt management, and insurance? (Here the best answer depends on your needs as a client.)

Authentic investment management should be inseparable from financial planning…and financial planning should include far more than simply identifying a retirement date and a dollar figure. In other words, choosing and managing investments is a building block and needs to be done with expertise. However, in our view, many of our clients’ greatest “returns” have come from our financial planning sessions together. And we stress “together” – a client who views their advisor as simply a mutual fund, but doesn’t see value in wading into the tax, legal, insurance, cash flow, and charitable planning areas will overlook a valuable resource.

- Do you earn fees for referring clients to specialists like estate attorneys or insurance agents? (No.)

No. We have no referral agreements, formal or implied. Since 1988 we have worked with hundreds of CPAs, attorneys, insurance agents, and other professionals. Armed with that knowledge and experience, we’re good judges of which professional would be a good fit for a client.

We also go an additional step and make ourselves available directly to our client’s other professionals. For example, last week, we consulted with a client’s CPA on tax efficiencies we want to explore, sat at the attorney’s table with a client during their estate drafting meeting, and analyzed medicare options with a client’s insurance agent.

- What is your investment philosophy?

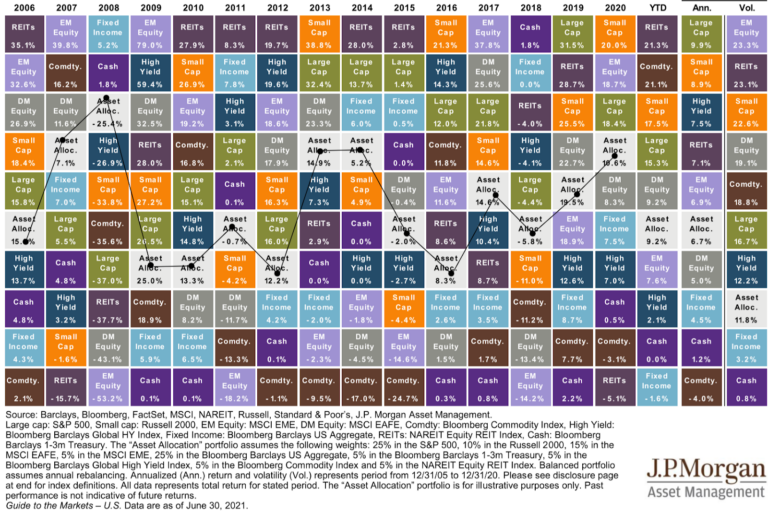

We invest in ways that stack the odds of success in our client’s’ favor. We believe that the greatest determinants of an investor’s success are controlling asset allocation, investment costs, and investor behavior. To this end, we primarily invest in a diversified allocation of tax efficient, low cost mutual funds and ETFs. Here is some research on why low cost funds (which tend to be index funds) stack the odds in the investor’s favor (How Expense Ratios and Star Ratings Predict Success, The Case For Low-Cost Index-Fund Investing, A Case For Index Fund Portfolios.)

- Do you believe in technical analysis or market timing? (No.)

We’re sure some people will beat the market by solely using technical analysis and market timing, however research shows this approach to be empirically unfounded, not to mention behaviorally difficult to bear. Long term, low-cost investing with systematic re-balancing tends to be the wisest approach to successful investing. Even Warren Buffett agrees..

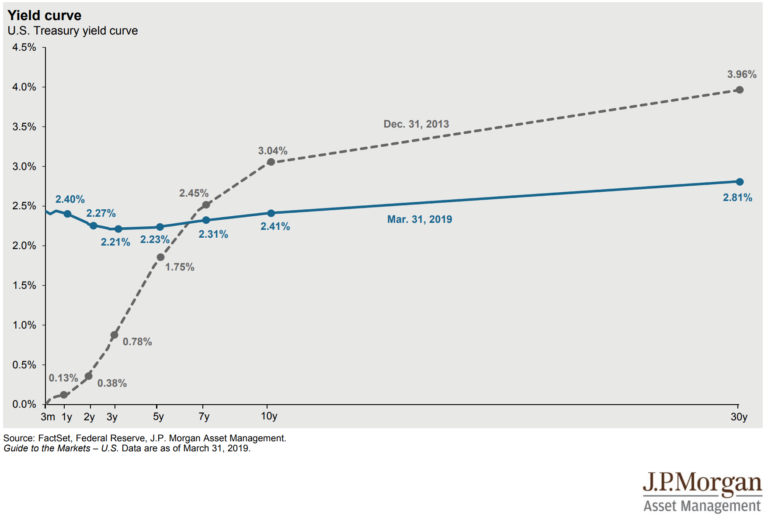

That said, we take into account the market’s valuation in our financial planning. For example, if a client has a $100,000 debt at 6%, they could pay it off and “earn” a guaranteed return of 6%. We would be much more inclined to use investment assets to pay off that debt if the market were priced at expensive valuations, but much less inclined to pay it off in the middle of a bear market when stocks are selling for much less than their fair value. That could be viewed as “market timing” but we see it as allocating capital to the highest risk adjusted return. (More on this in our blog post “What Should I Do With My Next $_______?”)

- Do you believe you can beat the market? (No.)

No and it isn’t our aim. Our goal is to invest efficiently, in a way that balances an investor’s “stomach for risk” (how much risk they can emotionally handle) with their “wallet” for risk (how much risk their financial plan can handle.)

Our core belief is that a fiduciary advisor should shoulder the weight of investing for a client while providing expertise in tax management, cost efficient investments, timely rebalancing, and behavioral coaching. Vanguard has spent over a decade researching and qualifying this value-add. According to their research, they estimate an advisor’s value-add to be in the range of 2-3% per year before accounting for the benefits of comprehensive financial planning.

- How often do you trade? (As seldom as possible, ideally once or twice a year at most.)

Typically trades are dictated by a client’s ongoing withdrawal/contribution plan, one-time cash needs/deposits, or our systematic rebalancing 1-2 times per year. Occasionally large shifts in the market or in a client’s life can also trigger a rebalance.

- How do you report investment performance? (After all expenses, compared to an average of highly similar assets that includes dividends or interest income, over the short and long term.)

We provide clients a quarterly report that details their performance after all fees and expenses compared to a risk-appropriate benchmark.

- Which professional credentials do you have, and what are their requirements? (Among the best are CFA [Chartered Financial Analyst], CPA [Certified Public Accountant] and CFP, which all require rigorous study, continuing education and adherence to high ethical standards. Many other financial certifications are marketing tools masquerading as fancy diplomas on an adviser’s wall.)

At Jonathan’s strong urging, I earned my CFA charter in 2008 and CFP designation in 2010. We are also involved members of professional organizations such as the Society of Financial Service Professionals (I am former president of the Greensboro Chapter and former National Board member of SFSP), the CFA Society of NC (I am a former board member), the National Association of Personal Financial Advisors (the organization for Fee-Only advisors which carries its own continuing education requirements) and the Financial Planning Association. Jonathan has been an affiliate member of CFA Institute since 1989.

- After inflation, taxes and fees, what is a reasonable estimated return on my portfolio over the long term? (If I told you anything over 3% to 4% annually, I’d be either naive or deceptive.)

It depends on the client’s time horizon and their ability (and willingness) to take on risk. In our financial planning, we typically estimate historically conservative returns in the 3-6% range. For a diversified portfolio, some years will be +15% some will be -10%; few will be exactly 3-6%. For example, since 1980 the S&P 500 (which is all stocks but illustrates the point) has returned an average of 8.5% per year, but in only six of those years has the the annual return been within 50% of 8.5% (4.25% to 12.75%). In other words, 83% of the years looked far from average. To address this, we run “bad timing” projections that take into account the possibility of lower than estimated returns in the initial years of retirement.

- Who manages your money? (I do, and I invest in the same assets I recommend to clients.)

We do and we invest with same same process and investments in our personal accounts as we do with our clients.